Criteo’s Q2 earnings report on Wednesday was marked by flatness.

Total revenue for the quarter inched up to $483 million, a 2% bump from the same time last year. At the same time, Criteo’s net income in Q2 – as in, real profit – dropped from $28 million to $23 million.

The company’s share price, after a brief initial spike, was flat over the course of the day.

Criteo has a compelling growth story, a strong base of retailer partners and a retail media business that’s growing at a double-digit rate. But investors are waiting to see whether Criteo’s total activated media spend improves.

That metric, which Criteo defines as all spend on behalf of retail media and performance advertisers, has hovered at around $1 billion for the past four quarters, noted Arete Research analyst Richard Kramer on the call.

“Growing activated media spend really is a top priority,” responded Criteo CEO Michael Komasinski.

The sunny side

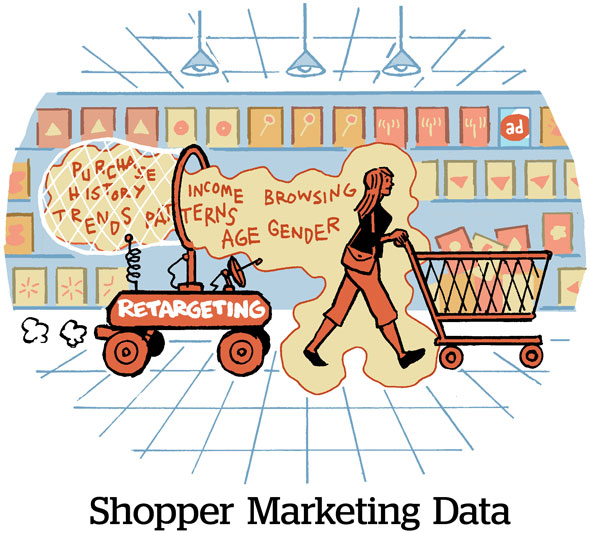

Yet Criteo’s retargeting and ad tech services businesses – the former core revenue driver and still almost half of revenue – are flat or declining. That’s because many retailers, merchants and big brands have in-housed those services.

However, Criteo does have a few growth engines.

One is its retailer network. Investors were shaken three months ago when Criteo’s earnings were down in part because two flagship clients, Uber and Roundel, which is the Target ads business, have reduced their work with Criteo.

At the time, Criteo execs on the call disclosed that the company had 225 retail partners on its roster. This quarter, Wells Fargo analyst Alec Brondolo wanted to know whether that number had declined any further.

“We don’t keep updating that number,” CFO Sarah Glickman said, but she did share that Criteo now partners with more than 230 retailers.

Criteo is having particular success with agency business growth.

Last month, Criteo announced a strategic partnership with Dentsu to integrate its commerce media product. It should be noted, however, that until very recently Komasinski, who joined Criteo in January, was CEO of Dentsu North America – so take that one with a grain of salt.

But Criteo struck another noteworthy deal. Earlier this week, so not included in its Q2 reckoning, it announced an integration with WPP Media, this one focused primarily on CTV and streaming video.

Agencies now account for 38% of Criteo’s retail media advertising segment, which is its fastest-growing channel, up from 30% a year ago, Glickman said.

The not so good

But now it’s time for the sad trombone.

In terms of negative impacts by sector, “we certainly see CPG being down just broadly depending on the category,” Glickman said.

And did you catch that mention earlier about how retargeting and ad tech services are the former core of Criteo’s business? Both are on a slow path of decline.

“There has been a little bit of a drag from our ad tech services units,” Komasinski said.

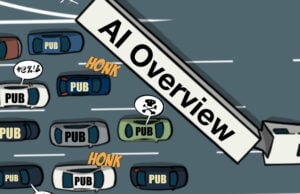

Glickman added that the ad tech services segment was down by “double-digit millions” year over year. “That was due to self-preferencing by the largest ad tech player,” she said.

That’s one way to say “Google” without saying “Google.”