Advertisers want more curated inventory and programmatic deals, especially for CTV campaigns. And Magnite is reaping the benefits, but not to the extent that investors were hoping to see.

The SSP beat its own Q2 revenue guidance thanks to growing demand for programmatic CTV activation and partnerships with big-name streamers, CEO Michael Barrett told investors on Wednesday.

But Magnite fell short of Wall Street’s revenue expectations for the quarter, resulting in a roughly 7% drop in its stock price in after-hours trading.

As its next major growth target, Magnite plans to capture a portion of Google’s share of the display and video market once the Department of Justice’s remedies for Google’s ad tech monopoly go into effect, Barrett said.

And it’s betting on closer relationships with agencies and DSPs, plus more demand from midsize advertisers, to help it eat some of Google’s lunch.

Not hitting the mark

Magnite reported revenue of $173 million in Q2, a 6% year-over-year increase. That exceeded its top-line expectation of $160 million for the quarter. But it missed Wall Street’s projections of $177 million in revenue and 8.8% growth.

Despite the revenue miss, the two main parts of Magnite’s SSP business, CTV and DV+, demonstrated solid growth for the quarter.

Its net revenue attributable to CTV was $71.5 million for Q2, up 14% YOY. Net revenue from DV+ – meaning everything other than CTV, including display and online video – was $90.4 million, up 8% YOY.

CTV was the main growth driver for Q2, Barrett said. “Our most significant growth came from Roku, Netflix, LG, Warner Bros. Discovery and Paramount this quarter.”

For example, Warner Bros. Discovery unveiled its NEO programmatic ad platform, which is powered by Magnite’s tech, during this year’s upfronts. And Magnite is also Netflix’s SSP partner for the new Netflix Ads Suite, which Barrett said could make Netflix one of Magnite’s “biggest clients on a run rate basis.”

Looking ahead, Magnite plans to release an in-house AI product that will allow publishers to automate the categorization of their CTV inventory into contextual segments, Barrett said. This product complements Magnite’s AI-powered audience discovery feature and its traffic-shaping integrations with DSPs.

Going after Google

But Magnite isn’t just focused on in-house growth opportunities. Barrett also put a target on Google’s share of the SSP and ad server markets.

He predicted that the fallout from the federal government’s antitrust ruling against Google’s ad tech business will make the SSP landscape much more competitive starting next year.

“It’s clear that, for years, Google has been engaging in illegal practices that resulted in an unfair auction within its ad server, which disproportionately drove volume through its SSP at the expense of rival SSPs like Magnite,” Barrett said.

Although Google intends to appeal the DOJ’s antitrust ruling, Barrett said he expects some of the DOJ’s proposed remedies to go into effect while the appeals process plays out.

That means SSPs will be better positioned to challenge Google’s dominance in online display and video, he said. Magnite estimates that Google currently has a 60% share of the display and video markets.

Although it is the second largest player in the space, Magnite still only has mid-single-digit shares of those markets, Barrett said. But Magnite should be “well positioned to capture any shift in market share that occurs as a result of Google ceasing its illegal practices, without any meaningful changes to our existing cost structure.”

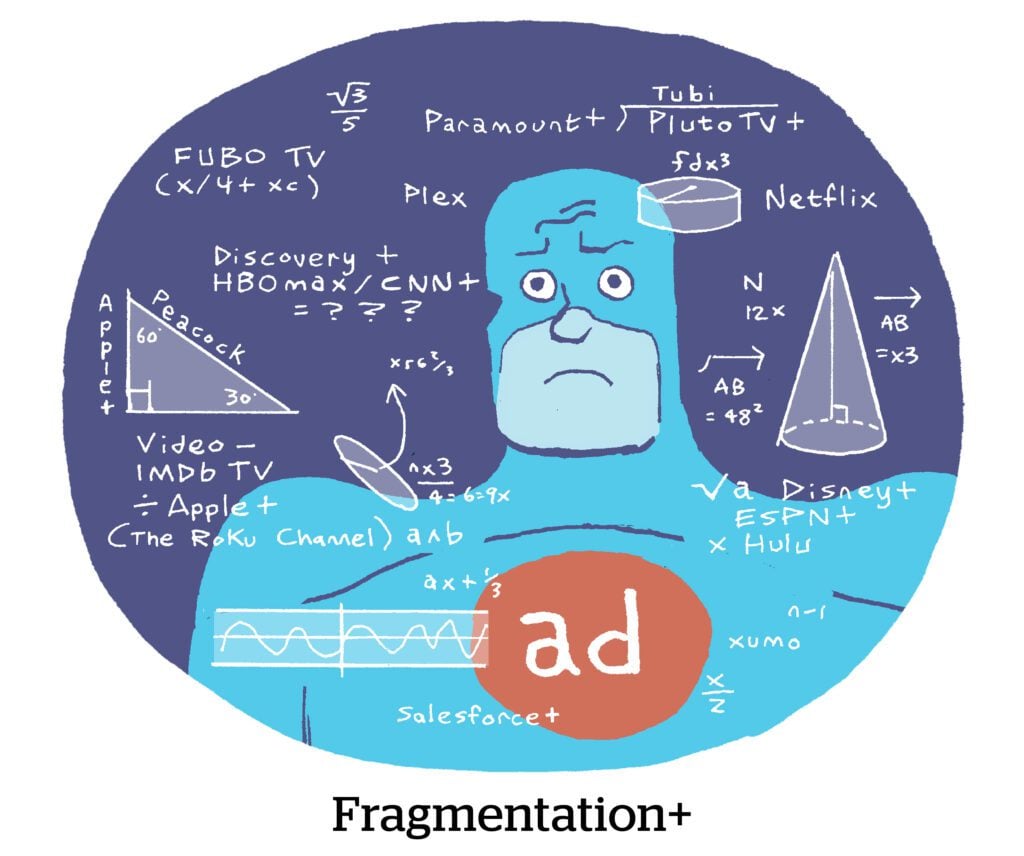

SMBs in CTV

All that said, Magnite isn’t waiting until next year to pursue growth opportunities. The company had a positive outlook for the remainder of the year, predicting that its net revenue, excluding the cost of traffic acquisition, will grow by 10% in 2025.

Barrett highlighted the ad industry’s ongoing obsession with deal curation, the increased prevalence of programmatic CTV deals among small and midsize brands and Magnite’s ownership of the SpringServe ad server as growth drivers.

On the curation front, he called out the buyer marketplace Magnite recently created for ad agency holdco dentsu in the EMEA market as an example of closer curation partnerships with major agencies.

And on the programmatic CTV front, Barrett highlighted live sports as a growing opportunity that’s still in its early days. He offered Magnite’s partnership with FanDuel Sports Network, which produces more than 3,000 live sporting events in local markets annually, as an example of a programmatically scaled sports integration.

And when it comes to bringing more SMBs into the CTV fold, Barrett pointed to MNTN going public as an encouraging sign, since it’s a DSP focused on smaller advertisers and video inventory.

“We see the SMB segment exploding over the next three to five years through newer, specialized DSPs like tvScientific, Vibe, Streamr and more,” Barrett said. “They’ll all need access to premium CTV supply through an integrated ad server and SSP; that’s exactly where Magnite is positioned to lead.”