People Inc. – the former Dotdash Meredith – is fighting on multiple fronts to keep its business growing as Google Search declines precipitously as a source of referral traffic, and consumers move to agentic AI to find answers to their questions.

People’s digital ad revenue increased 5% compared to Q2 2024. It’s a decent turnaround, considering its digital ad revenue grew just 1% YOY in Q1.

But referral traffic from Google Search is continuing to dry up, and People Inc. is facing downturns on the print side of the business. The 9% YOY growth in digital revenue offset a 9% YOY decrease in print revenue, with digital accounting for $260.4 million, compared to $173.5 million for print.

And investors were clearly not impressed by the performance of People’s parent company, IAC. IAC reported $586.9 million in Q2 revenue across its entire portfolio, which fell short of its forecasted earnings of $601.4 million.

The miss resulted in IAC’s stock price dropping by about 13% after the company reported earnings on Tuesday.

The AI search pivot

Two and a half years ago, People Inc. saw the writing on the wall regarding generative AI taking over search, CEO Neil Vogel told investors. He attributed the digital portfolio’s Q2 growth to the pivots the company has made since that time.

As recently as a few years ago, “90% of the traffic on the open web came through Google, and we got very good at Google,” Vogel said. “But we also noticed, coming out of the pandemic, Google started to send out less and less traffic to people like us.”

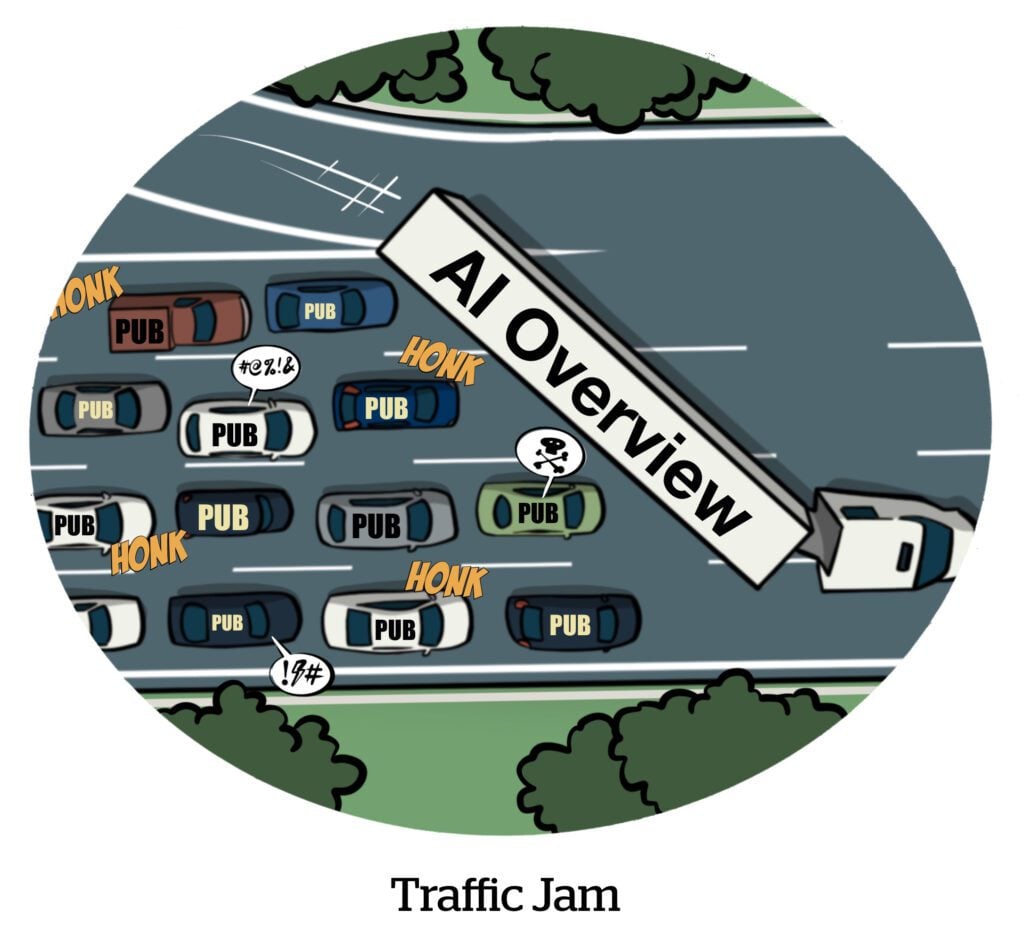

Referral traffic is declining, and the decline is growing more pronounced every quarter, Vogel said, as Google embraces zero-click generative AI search products like Google Gemini and generative AI Overviews that now appear at the top of its traditional search engine results.

In Q1, AI Overviews appeared on about 35% of search keywords associated with People Inc.’s content, he said. In Q2, that percentage grew to about 55%, he said, which “definitely depresses [click-through rate].”

The downturn in search traffic is “the reason why we’re doing everything we’re doing,” he added, alluding to People’s revenue diversification efforts and its doubling down on its D/Cipher+ in-house contextual ad tech.

However, the company wasn’t completely caught off guard by the AI search upheaval, Vogel said.

Around the time OpenAI’s ChatGPT became commercially available two years ago, the former Dotdash Meredith had “a very fateful meeting” with OpenAI CEO Sam Altman, he said. This meeting convinced the company that there would be a search answer replacement, and Vogel determined that “we need to have leverage.” That revelation led to the company’s partnership with OpenAI, which was announced last May.

People is also taking a harder stance against unlicensed scraping of its content by AI platforms. It is working with Cloudflare to block almost all AI crawlers other than those operated by OpenAI, Vogel said.

Although it can’t block Google’s crawlers, he added, because Google uses one crawler for AI scraping and search indexing.

So, while Google referrals might be down, the company can’t abandon the Google Search index entirely.

Ad business insights

While People’s once reliable stream of Google traffic will likely remain volatile, Vogel said, he highlighted two bright spots for future growth: its deal with OpenAI and its own use of AI to improve D/Cipher+ campaign performance.

In other words, generative AI tech is not just a net negative for the media company, according to Vogel.

But the D/Cipher+ business, which focuses on using contextual targeting to drive performance campaigns across People’s owned and operated portfolio and a network of third-party publishers, remains a small part of People’s overall revenue mix, Vogel said. He expects D/Cipher+ to be a “material contributor” come 2026.

Programmatic pricing was flat for much of Q2, said IAC CEO Joey Levin, but it began to pick up in June, and currently, ad pricing across the entire People Inc. portfolio is up about 10% YOY.

Direct-sold premium campaigns also helped offset some weakness in programmatic demand due to uncertainty around tariffs and trade, Levin said.

Going off-platform

To future-proof the business from fluctuations in search traffic and programmatic demand, People is also diversifying into new revenue streams like email newsletters, live events and content licensing and syndication, Vogel said.

Because of the licensing and syndication push in particular, People has shored up its “off-platform audiences across Apple News, YouTube, Instagram and TikTok,” he said. People’s licensing and other revenue increased 23% YOY in Q2, which the company attributed to improved performance from Apple News and a full quarter of revenue from the OpenAI deal.

People has steadily grown site visits to its core publisher properties over the past three years, as part of its diversification strategy, even as the share of those sessions that originate from Google Search has shrunk.

The shifts in referral traffic have been stark: In Q2 2023, People’s core sites attracted 1.99 billion sessions, with 52% of these sessions coming from Google. But in Q2 2025, its core sites attracted 2.2 billion sessions, and only 28% of these sessions originated from Google.

Meanwhile, over the past three years, People has also grown its portfolio’s off-platform views across ChatGPT and syndicated platforms like Apple News. Off-platform views totaled 9.5 billion in Q2 2023, but increased to 14.7 billion in Q2 2025.

However, off-platform views are apparently harder to monetize. People’s off-platform digital revenue for Q2 this year was $93 million, or 36% of its total – even though the publisher generated seven times as many off-platform views as it did on-platform views.

Still, rather than focusing on its owned-and-operated properties, People now believes “we need to aggregate audience from as many sources as possible,” Vogel said. Doing so, he said, will ensure the business remains healthy even if Google referral traffic approaches zero.