This week, everyone in retail and ecommerce is digesting their performance from Amazon Prime Day, which has outgrown its 24-hour roots and this year went for a four-day online shopping bonanza for the first time.

Having covered Amazon’s Prime Day since some of its earliest incarnations, before it was even a mere two-day festival of deals, this year’s event stood out in a couple important ways. One is the blasé results of Prime Day; the other is the guerilla pricing tactics adopted by brands and merchants that sell on Amazon and elsewhere across the web.

Is there an Amazon ceiling?

Firstly, Amazon’s own post-Prime Day recaps have always been boastful. The company loves to tout that it’s the biggest shopping days ever and delivers the most-ever sales across a swathe of major consumer products. I’ve always thought that, the real story would be when Amazon stopped making such grandiose boasts in its press release. Given the general cumulative growth of ecommerce, of Prime memberships and of Amazon Prime’s expansion to new markets, it seemed like a fair bet not to happen for some time.

Well, “some time” just happened.

“This year’s Prime Day event was bigger than any previous four-day period that included a Prime Day event,” according to Amazon’s annual recap.

And while Amazon may have outperformed other Prime Days in its first-ever Prime Week, it’s entirely plausible that a two-day promotion like last year would have seen a decrease not just in growth rate, but in total sales.

This isn’t exactly an alarm bell, though. Years are relative. And 2025 was the year of Liberation Day tariffs. It’s telling that Amazon touted 2025 as delivering “more savings than any previous Prime Day event,” without making the typical claims regarding its cumulative sales.

People are probably looking for deeper discounts and stocking up on items before a great deal more tariffs come into effect later in the summer. But it could also be that Amazon has reached Prime Day plateau, and that while it may continue to grow modestly in line with Prime subscriptions, it won’t necessarily be a crazy year-over-year expansion.

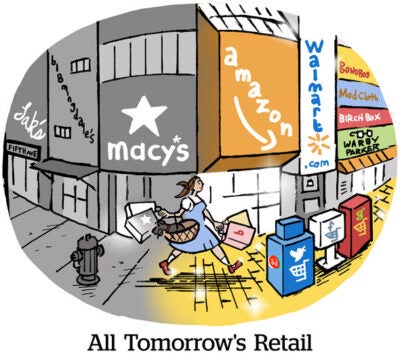

In 2018 when Prime Day moved to two days, the expansion of ecommerce meant the expansion of Amazon. Its online marketplace claimed practically all ecommerce market share growth coming online at the time. Fast forward to 2025, and US brick-and-mortar retailers enjoyed the most year-over-year growth during Prime Week, according to Adobe’s retail sales report covering Prime Day. American retail chains saw 30% annual growth during Prime Day 2025 (though, again, that’s with a couple bonus days tacked on).

All American consumers can now enjoy the fruits of Prime Day deals, regardless of whether they have the Amazon Prime subscription.

On the other hand, all the other traditional retailers owe Amazon a debt of gratitude, and clearly should long ago have established a major shopping occasion during the late-summer, back-to-school period.

At what price?

Another striking feature of Prime Day this year was the web-wide pricing tactics taken by brands and product sellers to push Prime Day deals while avoiding and managing Amazon’s tyrannical pricing algorithm.

Let me explain.

Amazon sellers can list their products for a higher price on Amazon than on their own site or a different retailer’s site, but Amazon’s ranking algo will likely hate them for it. The product is unlikely to appear organically and may even be deprived of key paid media placements.

For Prime Day in particular, when deals are set up well ahead of time, the Amazon pricing algorithm scrutinizes historical prices and the prices for the same item set elsewhere across the web every day leading up to and during the event. When Amazon offers, say, a 40% Prime Day deal on some popular kitchen appliance, it goes to great lengths to ensure the price really is discounted by that much from what people might expect to pay for in-store or online right now.

The Amazon pricing algo “is Eye of Sauron-level persistent,” as one brand marketer and a multi-year Prime Day advertiser told me. It can fall on product sellers that have their items discounted by another retailer even when they don’t control those prices.

The pricing algo has been a particular pain point lately, one Amazon seller consultant told me, because sudden price increases can easily lead to loss of access to Amazon’s coveted “Buy Box” and other featured placements. Many brands have gradually raised prices on Amazon starting six to 10 weeks, according to two Amazon sellers. A sudden 10% increase following a tariff implementation would be flagged by the pricing algorithm. And, having established a higher price, the brand might offer a more attractive Prime Day discount.

On the other hand, trying to out-maneuver the Amazon algorithm can mean losing access to all those paid promotional opportunities at just the wrong moment.

Which is why I found it surprising that many products with big Prime Day promos, per online shopping aggregators like the Wirecutter, matched or even offered better discounts on their sites or with a competitive retailer. [Note – those links are obviously out of date.]

These discounts slide beneath the radar of the “Eye of Sauron” algo because the discounts aren’t easily detectable via feed or API. Levi’s, first instance, offered a major extra discount at checkout on its site if people sign up for its Red Tab membership, which requires only submitting an email. There were a pair of Teva shoes with a Prime Day deal but a bigger discount was to be found buying them directly on REI’s site with an REI membership or by agreeing to a store pickup sale.

What’s important is that the prices listed on the page and in the product pricing feed, which is what the Amazon algo reads, do not reflect a discount tacked on by the individual just before checkout.

“Price reflects in cart” seems to be The Wirecutter’s particular nomenclature for this dynamic, when on Prime Day items across the web are given this magical discount pixie dust. It doesn’t look like a deal that undercuts Amazon, but just wait.

These measures may seem strange and convoluted to normal shoppers, but to the initiated they’re clearly efforts to push Prime Day deals everywhere while avoiding the inquisitorial Amazon algo. These off-Amazon Prime Day discounts aren’t revealed in the normal website metadata or the pricing feed all sellers provide to Amazon.

Long may they thrive under Amazon’s watchful eye.